Yet, the higher and further women get in their careers, it’s clear that barriers still remain. Today’s interactive timeline comes to us from Alex Architektonidis of BoardEx, and it tracks all the women chief executive officers (CEOs) of companies listed in the S&P 500 index since the turn of the century. The kicker? Across the 500 large-cap companies in the index, only 70 women have ever held the position of CEO or similar titles—and only 28 women currently have this status.

Which Industries Have the Most Women CEOs?

The S&P 500 covers approximately 80% of the U.S. equity market by capitalization. Since the index is fluid and regularly updated, women CEOs were selected based on whether their company was listed in the index during their tenure. Out of all the sectors represented on the timeline, the top categories are retail with 14 women CEOs, engineering and tech with 10 women CEOs, and finance with 9 women CEOs. Food & beverage and utilities are tied with 7 women CEOs each.

Women Leading in the Corporate World

Topping the list is Marion Osher Sandler, the first and longest-serving woman CEO in the United States. She held the title for nearly 27 years at Golden West Financial Corp (from 1980 to 2006), a company she co-founded and grew to $125 billion in assets. The next person in line for the longest female-led CEO term is Debra A Cafaro, from the healthcare-focused real estate investment trust Ventas Inc. Cafaro has been CEO of Ventas for 20 years, and generated a cumulative total return of 2,559% since 1999—the S&P average for returns over the same time period was only 215%. Only two women CEOs show up more than twice on the timeline. The first is Meg Cushing Whitman, who served as President/CEO of Ebay from 1998–2008, Chairman/President/CEO of HP Inc. from 2011–2015, and finally as the CEO of Hewlett Packard from 2015 to 2018. In total, Whitman has spent over 16 years as CEO of these S&P 500 companies. However, Carol Ann Bartz also has an impressive CV, with nearly 17 years as a CEO under her belt. Bartz was the Chairman/President/CEO of the software corporation Autodesk from 1992–2006, and later on at Yahoo from 2009 to 2011. The most recent addition to this list is Julie Spellman Sweet, who became the CEO of Accenture on September 1st. She was previously the CEO of Accenture’s North American division, and has been crowned on Fortune’s “Most Powerful Women” list from 2016–2018 consecutively. Sweet’s appointment aligns well with Accenture’s corporate diversity targets—the company is aiming for 25% women in managing director roles globally by 2020.

There’s More Work To Be Done

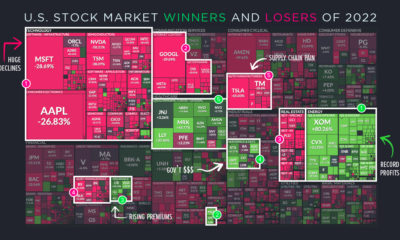

There’s a growing body of evidence that corporate diversity improves a company’s financial bottom line. A recent CNBC analysis shows that in 2019, over half of female CEOs led their company’s stocks to outperform the S&P 500 index, with some even showing quadruple-digit percentage returns (as previously mentioned with Ventas). Despite womens’ contributions to nearly half the labor force and consistent success as CEOs, they are disproportionately represented higher up the ladder. Women CEOs still lead a meager 5.6% of S&P 500 companies overall—in fact, women CEO appointments are actually slowing down, averaging less than 6% since 2015. Such stunted growth is setting back equality at the C-suite level drastically. A joint report between the non-profit Lean In and the consulting firm McKinsey & Co. offers some insight into the reasons underlying this disparity: —Women in the Workplace 2018 on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.