For the first half of the year, we were warned early and often by authorities that the Brexit vote could be a calamity for the ages. For example, the IMF claimed that a “Leave” result would threaten to “cause severe damage”, while Standard and Poor’s said that it would “paralyze” investment in the UK. But, it turns out that the real Brexit casualty isn’t the UK economy – instead it is the reputation of the many professional economists who wrongly predicted doom and gloom as the likely aftermath.

The Story So Far

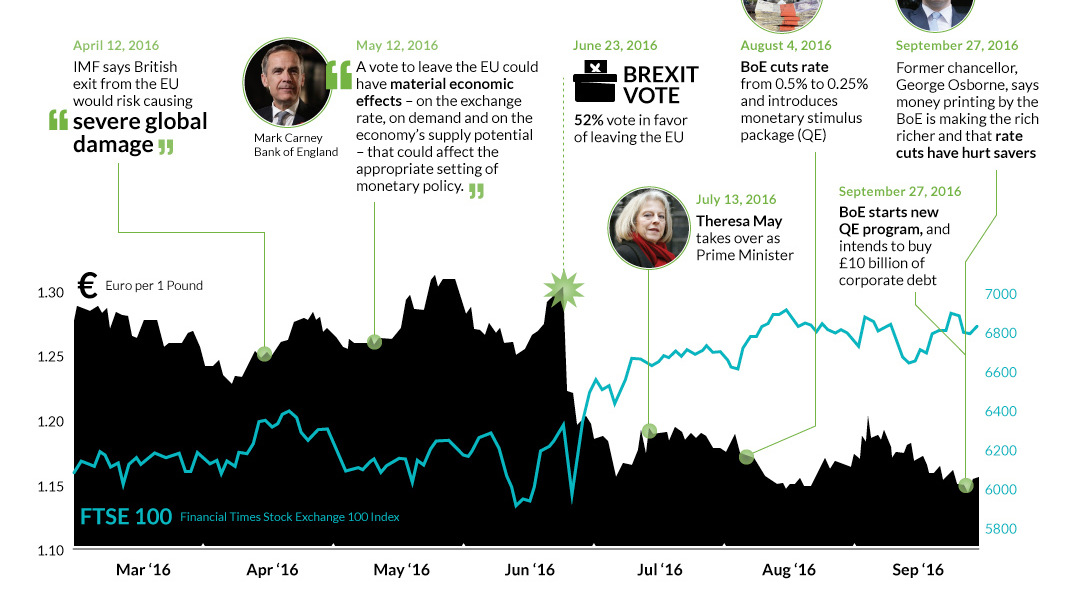

Today’s chart looks at the three months before and after the Brexit vote, which took place on June 23, 2016. The two charts tracked are the GBP/EUR and the FTSE 100. The former is the price of the British pound in terms of euros, and the latter is a major stock index that includes the largest companies listed in London, such as Barclays, Glencore, HSBC, Royal Dutch Shell, or Sainsbury’s. As expected, both markets have seen some action in the aftermath of the vote to leave. The pound has depreciated in terms of euros, but it is still higher now than it was from 2009-2011 in the post-crisis period. Against the ultra-strong USD, the pound is at decade-lows – but many other currencies are in similar territory as well. The FTSE 100 is another story. It’s relatively close to all-time highs – and even despite the fears of a potential collapse of Deutsche Bank, it’s climbed over 12% since the initial Brexit slump. In both cases, the action was partly underscored by the Bank of England, which announced a new stimulus program (QE) after its August meeting, while cutting rates from 0.5% to 0.25%.

Other Indicators

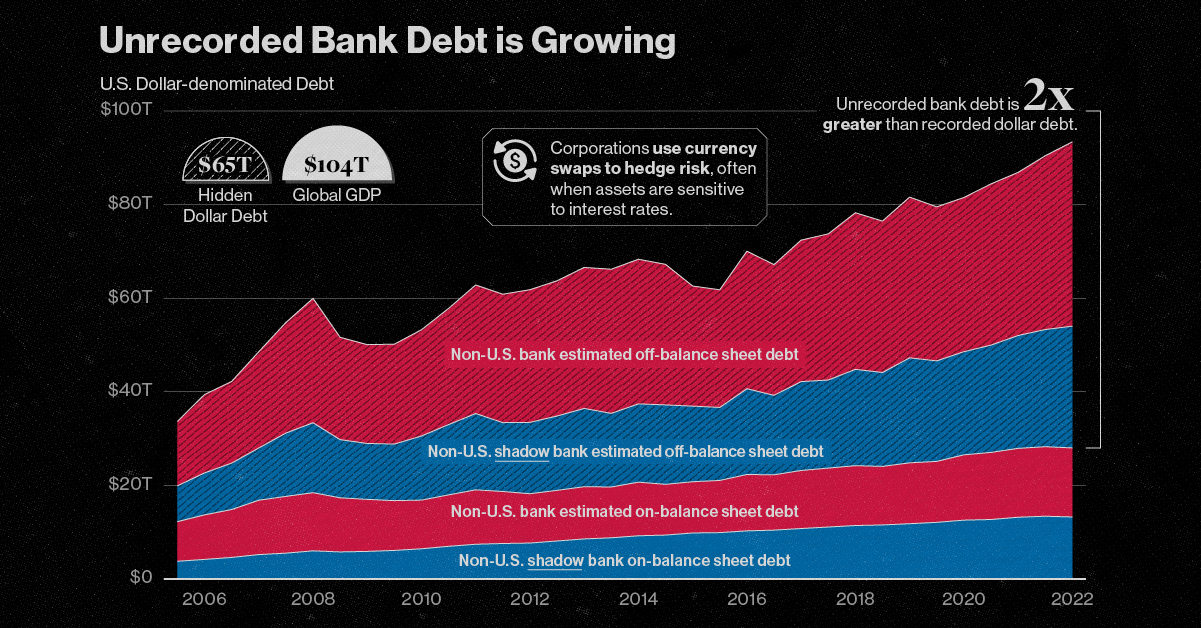

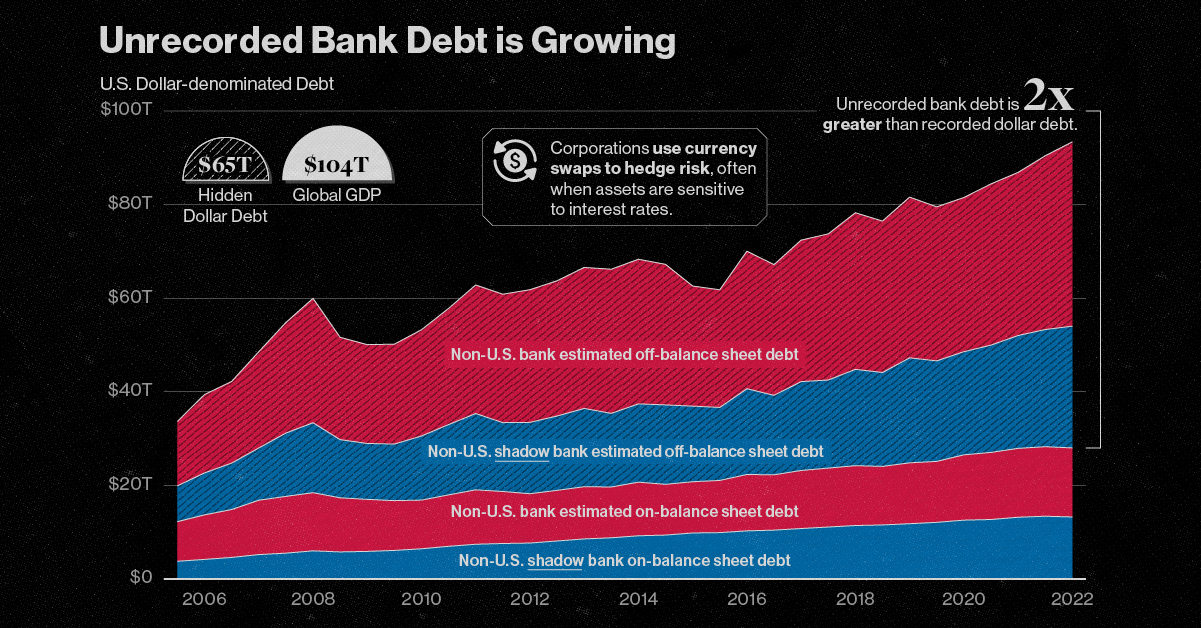

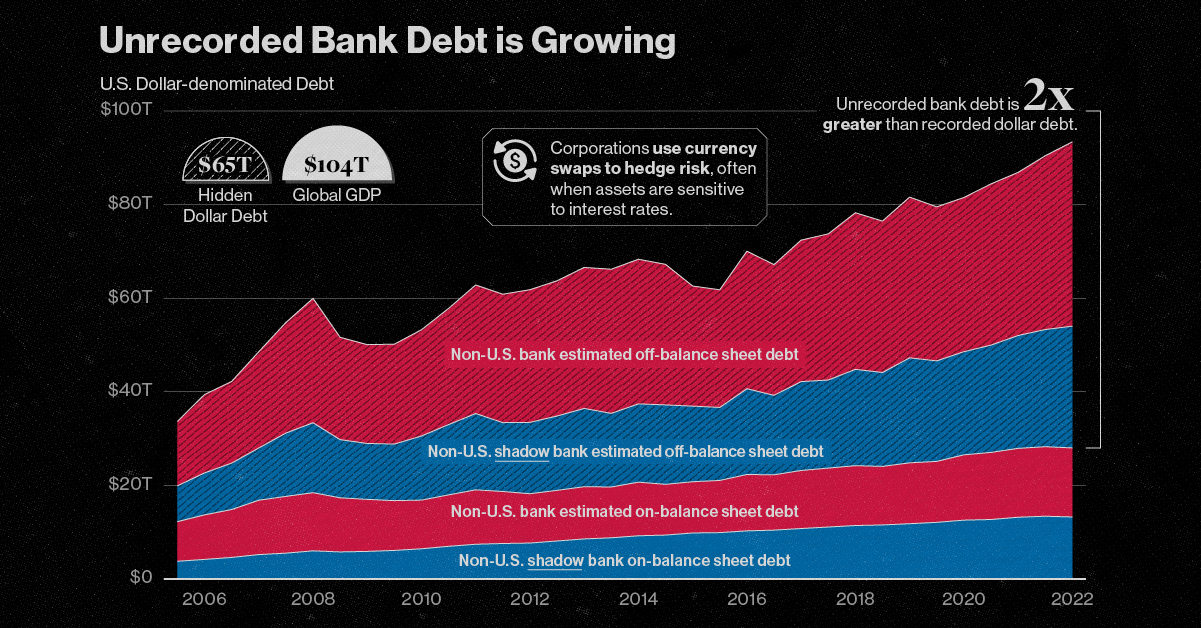

While there’s been movement in the currency and equity markets, other economic indicators have been status quo or better for the UK so far. Retail sales beat in July and August, and unemployment remains at 11-year lows. Purchasing manager indices dropped temporarily, but jumped back up. The economists that predicted that the sky was falling? They’ve been forced to revise growth expectations back up, at least on a short-term basis. It’s been dubbed the “Brexit Bounce” by The Spectator, a conservative magazine based in London. While there is likely still going to be some long-term fallout from the Brexit decision, many “experts” blew it on this one. on The scale of hidden dollar debt around the world is huge. No less than $65 trillion in unrecorded dollar debt circulates across the global financial system in non-U.S. banks and shadow banks. To put in perspective, global GDP sits at $104 trillion. This dollar debt is in the form of foreign-exchange swaps, which have exploded over the last decade due to years of monetary easing and ultra-low interest rates, as investors searched for higher yields. Today, unrecorded debt from these foreign-exchange swaps is worth more than double the dollar debt officially recorded on balance sheets across these institutions. Based on analysis from the Bank of International Settlements (BIS), the above infographic charts the rise in hidden dollar debt across non-U.S. financial institutions and examines the wider implications of its growth.

Dollar Debt: A Beginners Guide

To start, we will briefly look at the role of foreign-exchange (forex) swaps in the global economy. The forex market is the largest in the world by a long stretch, with trillions traded daily. Some of the key players that use foreign-exchange swaps are:

Corporations Financial institutions Central banks

To understand forex swaps is to look at the role of currency risk. As we have seen in 2022, the U.S. dollar has been on a tear. When this happens, it hurts company earnings that generate revenue across borders. That’s because they earn revenue in foreign currencies (which have likely declined in value against the dollar) but end up converting earnings to U.S. dollars. In order to reduce currency risk, market participants will buy forex swaps. Here, two parties agree to exchange one currency for another. In short, this helps protect the company from unfavorable foreign exchange rates. What’s more, due to accounting rules, forex swaps are often unrecorded on balance sheets, and as a result are quite opaque.

A Mountain of Debt

Since 2008, the value of this opaque, unrecorded dollar debt has nearly doubled.

*As of June 30, 2022

Driving its rise in part was an era of rock-bottom interest rates globally. As investors sought out higher returns, they took on greater leverage—and forex swaps are one example of this.

Now, as interest rates have been rising, forex swaps have increased amid higher market volatility as investors look to hedge currency risk. This appears in both non-U.S. banks and non-U.S. shadow banks, which are unregulated financial intermediaries.

Overall, the value of unrecorded debt is staggering. An estimated $39 trillion is held by non-U.S. banks along with $26 trillion in overseas shadow banks around the world.

Past Case Studies

Why does the massive growth in dollar debt present risks? During the market crashes of 2008 and 2020, forex swaps faced a funding squeeze. To borrow U.S. dollars, market participants had to pay high rates. A lot of this hinged on the impact of extreme volatility on these swaps, putting pressure on funding rates. Here are two examples of how volatility can heighten risk in the forex market:

Exchange-rate volatility: Sharp swings in USD can spur a liquidity crunch U.S. interest-rate volatility: Sudden rate fluctuations can mean much higher costs for these trades

In both cases, the U.S. central bank had to step in to provide liquidity in the market and prevent dollar shortages. This was done through pumping cash into the system and creating swap lines with other non-U.S. banks such as the Bank of Canada or the Bank of Japan. These were designed to protect from declining currency values and a liquidity crunch.

Dollar Debt: The Wider Implications

The risk from growing dollar debt and these swap lines arises when a non-U.S. bank or shadow bank may not be able to hold up their end of the agreement. In fact, on a daily basis, there is an estimated $2.2 trillion in forex swaps exposed to settlement risk. Given its vast scale, this dollar debt could have greater systemic spillover effects. If participants fail to pay it could undermine financial market stability. Because demand for U.S. dollars increases during market uncertainty, a worsening economic climate could potentially expose the forex market to more vulnerabilities.