Unfortunately, the network of 59,000 vessels powering international commerce runs on sulfur-laden bunker fuel, and resulting emissions are causing problems on dry land. As today’s infographic by Breakwave Advisors demonstrates, new emissions regulations taking effect in 2020 will have a big impact on the world’s massive fleet of marine shipping vessels.

The Regulatory Impact

The International Maritime Organization (IMO) – the UN agency responsible for ensuring a clean, safe, and efficient global shipping industry – will be implementing new regulations that will have massive impact on maritime shipping. The regulations, dubbed IMO 2020, will enforce a 0.5% sulfur emissions cap worldwide starting January 1, 2020 ─ a dramatic decrease from the current emissions cap of 3.5%. Here are a few ways marine fuel will likely be affected by these regulations:

High-sulfur fuel oil will drop in price as the demand drops dramatically after January 1, 2020 Diesel, a low-sulfur fuel oil, will be in higher demand and should see a price increase Refiners should also expect higher profits as refining runs increase to satisfy the new regulations

The Economic Impact

IMO 2020 will be one of the most dramatic fuel regulation changes ever implemented, with a significant impact on the global economy. New regulations are certain to influence freight rates ─ the fees charged for delivering cargo from place to place. These rates can fluctuate depending on:

Time and distance between ports Weight and density of the cargo Freight classification Mode of transport Tariffs and taxes Fuel costs

Rising fuel costs means rising freight rates, with much of these costs being passed to consumers. ─ Goldman Sachs

The Environmental Impact

Not surprisingly, the world’s 59,000 transport ships, oil tankers, and cargo ships have a consequential impact on the environment. Bunker fuel accounts for 7% of transportation oil consumption (~3.5 million barrels/day). Burning this fuel generates about 90% of all sulfur oxide and dioxide (SOx and SO2) emissions globally. In fact, the world’s 15 largest ships produce more SOx and SO2 emissions than every car combined. These sulfur emissions can cause several harmful side effects on land ─ acid rain, smog, crop failures, and many respiratory illnesses such as lung cancer and asthma.

Changing Currents in the Shipping Sector

As IMO 2020’s implementation date nears, shippers have a few courses of action to become compliant and manage costs.

- Switch to low-sulfur fuel Bunker fuel use in the shipping industry was 3.5 million barrels per day in 2018, representing roughly 5% of global fuel demand. Annual bunker fuel costs are predicted to rise by US$60 billion in 2020, a nearly 25% increase from 2019. Price increases this significant will directly impact freight rates ─ with no guarantee that fuel will always be available.

- Slower Travel, Less Capacity The costs of refining low-sulfur fuel will increase fuel prices. To offset this, shippers often travel at slower speeds. For example, large ships might burn 280-300 metric tons of high-sulfur fuel oil (HSFO) a day at high speeds, but only 80-90 metric tons a day at slower speeds. Slower travel may cut costs and help reduce emissions, but it also decreases the capacity these vessels can transport due to longer travel times, which shrinks overall profit margins.

- Refueling Detours Adequate fuel supply will be a primary concern for shippers once IMO 2020 takes effect. Fuel shortages would cause inefficiencies and increase freight rates even more, as ships would be forced to detour to refuel more often.

- Installing Scrubbers A loophole of IMO 2020 is that emissions are regulated, not the actual sulfur content of fuel itself. Rather than burning more expensive fuel, many shippers may decide to “capture” sulfur before it enters the environment by using scrubbers, devices that transfer sulfur emissions from exhaust to a disposal unit and discharges the emissions. With IMO 2020 looming, only 1% of the global shipping fleet has been retrofitted with scrubbers. Forecasts for scrubber installations by mid-2020 run close to 5% of the current ships on the water. There are a few reasons for such low numbers of installations. First, scrubbers are still somewhat unproven in maritime applications, so shippers are taking a “wait and see” approach. As well, even if a ship does qualify for a retrofit, cost savings won’t take effect until several years after installation. On the plus side, ships with scrubbers installed will still be able to use the existing, widely-available supply of bunker fuel.

Moving Forward

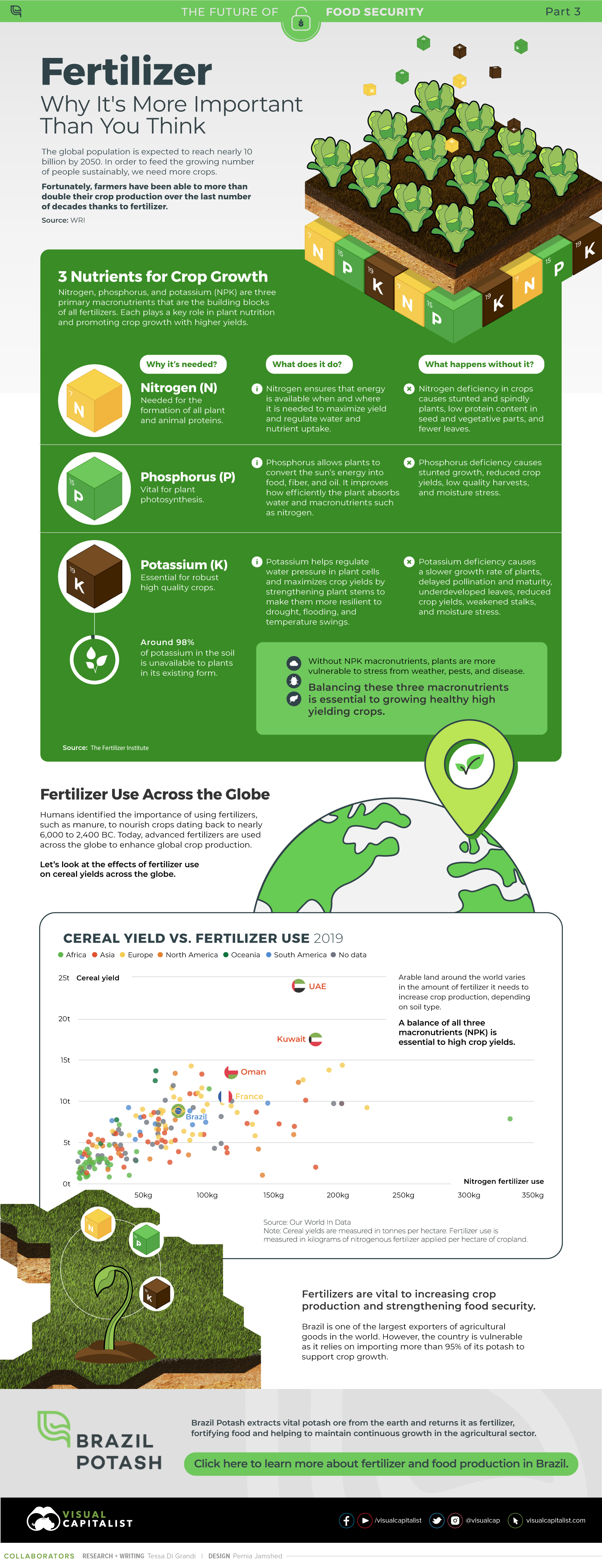

No matter which route shippers choose to take, the short-term impact is almost certainly going to mean higher freight rates for the marine shipping industry. on Over recent decades, farmers have been able to more than double their production of crops thanks to fertilizers and the vital nutrients they contain. When crops are harvested, the essential nutrients are taken away with them to the dining table, resulting in the depletion of these nutrients in the soil. To replenish these nutrients, fertilizers are needed, and the cycle continues. The above infographic by Brazil Potash shows the role that each macronutrient plays in growing healthy, high-yielding crops.

Food for Growth

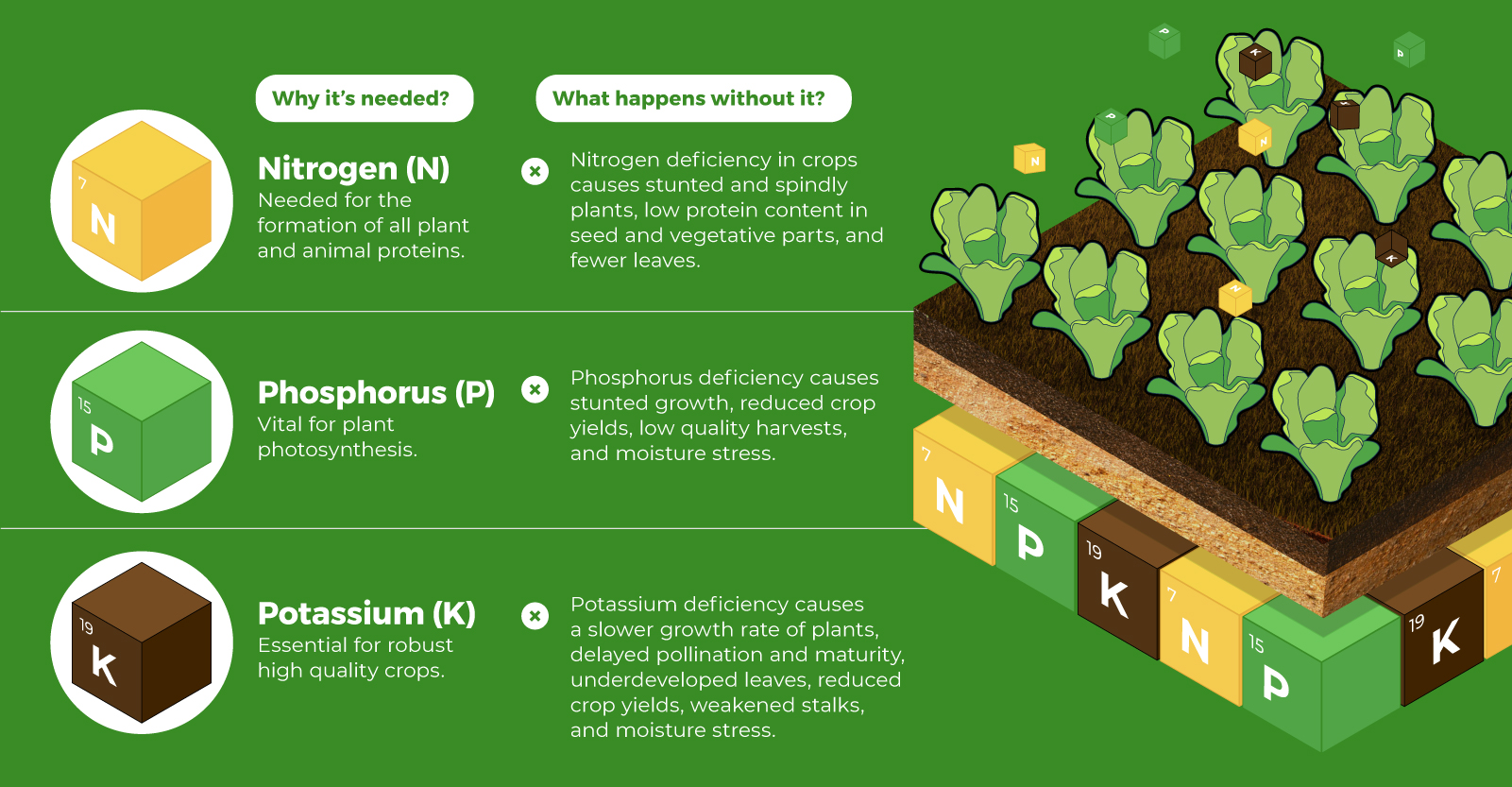

Nitrogen, phosphorus, and potassium (NPK) are three primary macronutrients that are the building blocks of the global fertilizer industry. Each plays a key role in plant nutrition and promoting crop growth with higher yields. Let’s take a look at how each macronutrient affects plant growth. If crops lack NPK macronutrients, they become vulnerable to various stresses caused by weather conditions, pests, and diseases. Therefore, it is crucial to maintain a balance of all three macronutrients for the production of healthy, high-yielding crops.

The Importance of Fertilizers

Humans identified the importance of using fertilizers, such as manure, to nourish crops dating back to nearly 6,000 to 2,400 BC. As agriculture became more intensive and large-scale, farmers began to experiment with different types of fertilizers. Today advanced chemical fertilizers are used across the globe to enhance global crop production. There are a myriad of factors that affect soil type, and so the farmable land must have a healthy balance of all three macronutrients to support high-yielding, healthy crops. Consequently, arable land around the world varies in the amount and type of fertilizer it needs. Fertilizers play an integral role in strengthening food security, and a supply of locally available fertilizer is needed in supporting global food systems in an ever-growing world. Brazil is one of the largest exporters of agricultural goods in the world. However, the country is vulnerable as it relies on importing more than 95% of its potash to support crop growth. Brazil Potash is developing a new potash project in Brazil to ensure a stable domestic source of this nutrient-rich fertilizer critical for global food security. Click here to learn more about fertilizer and food production in Brazil.