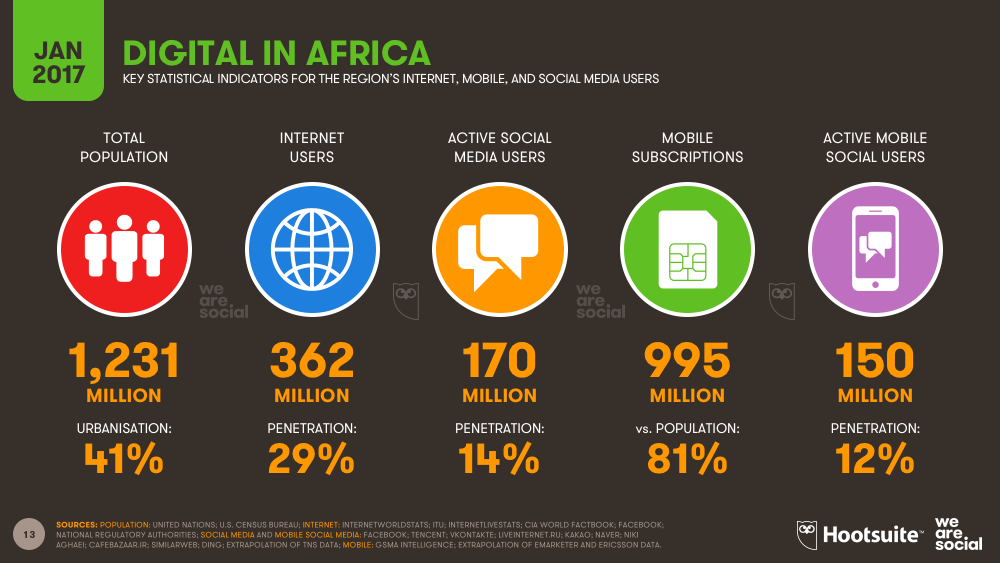

Africa is home to the fastest growing cities, and more than half of the world’s population growth will take place on the continent over the coming decades. By 2050, cities like Lagos and Kinshasa will be global megacities, each holding well over 30 million inhabitants. Africa is also at the start of a technological renaissance. It was recently reported by WeAreSocial that 7 of 10 of the world’s fastest growing internet populations are in Africa – the beginning of a trend that will likely re-shape entire economies as new companies leapfrog established technology, ideas, and infrastructure. That said, much of that opportunity lies in the future. As of today, internet penetration is just 29% throughout Africa, meaning that the majority of growth and network effects are still to come.

A New Startup Ecosystem Emerges

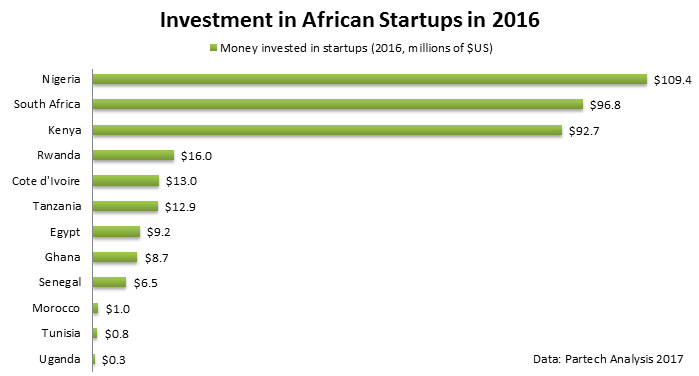

Today’s infographic from GSMA shows the 300+ hubs that have emerged in the African tech startup ecosystem. Many of these plan to take advantage of the aforementioned growth potential, including the 360 million smartphone owners expected on the continent by 2025. Investors are recognizing the potential as well. Last year, it was estimated that African startups raised a record-breaking total of $366.8 million in investment. Here’s that distribution sorted by country:

In what sectors did most of the action happen? According to a separate report by Disrupt Africa, the fintech sector received the most funding in 2016, but the agri-tech sector saw the biggest percentage growth as compared to the previous year. Other sectors that got substantial amounts of attention include solar, health, e-commerce, entertainment, and e-learning.

Unique Opportunities

Every startup ecosystem is different, and hubs in Africa are no exception. In particular, the continent has a unique wrinkle that also presents a huge opportunity: according to the African Development Bank, about 55% of sub-Saharan Africa’s economic activity is informal. – Jake Bright, World Economic Forum Last year, Africa Internet Group became the first unicorn on the continent after receiving investments from Goldman Sachs, Rocket Internet, AXA Group, Orange, and others. It’s also certain to be just one of many born on the African Savannah. on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.