The sophisticated players in this funding landscape make significant amounts of dough by spotting game-changing opportunities in their early stages, and then applying their insights, connections, and experience to these startups to make them financially viable. Finally, they guide the successful company to an exit, take their returns, and then distribute to the partners. But what if startups, especially those related to the blockchain, were able to raise money from everyone simultaneously? What if the traditional gatekeepers didn’t matter as much?

ICOs vs. Venture

Last year, it became clear that Initial Coin Offerings (ICOs) would start to challenge traditional venture capital, as funding raised through them exploded by over 20x. Today’s infographic from Vanbex Ventures shows key statistics around this phenomenon, as well as the evolving reception from venture capital and institutional investors.

Needless to say, the relationship between ICOs and venture capital is a conflicted one. On one hand, it represents the inevitable disruption of many different elements of the traditional business model. On the other hand, the ICO space is too tantalizing to ignore: cryptocurrencies are worth nearly $0.5 trillion, and those that put money in early saw returns in the quadruple digits.

Getting Onboard?

The $5.3 billion boom in ICOs in 2017 had no problems surpassing traditional early-stage venture capital for blockchain-adjacent startups, which only saw $0.95 billion in funding. While most VCs were slow to adapt, there have been increasing signs of interest – even despite the existing regulatory concerns. In particular, the idea of additional liquidity appeals to these investors since tokens can be sold at any point. This gives an advantage over traditional models, where a liquidity event such as an IPO or acquisition is necessary. As a result, some VCs are shifting how they work with blockchain startups. They will pre-acquire tokens prior to a public ICO, and even consult with startups to help them maximize the value of tokens and the underlying technology.

Going Institutional

The crypto asset class is also becoming more ubiquitous among institutional investors as well. – Dan Morehead, CEO and CIO of Pantera Capital In fact, 17% of global hedge fund managers say they currently (or plan to) invest in cryptocurrency. At the same time, over 100 crypto hedge funds have popped up over the years – another sign of a widening and market landscape.

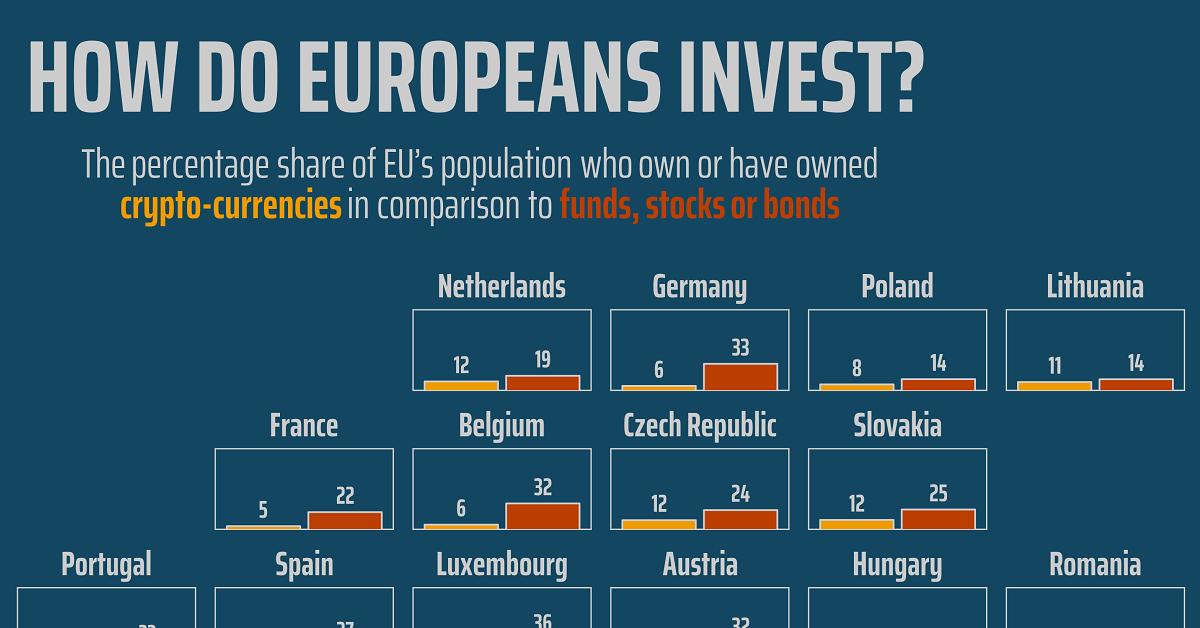

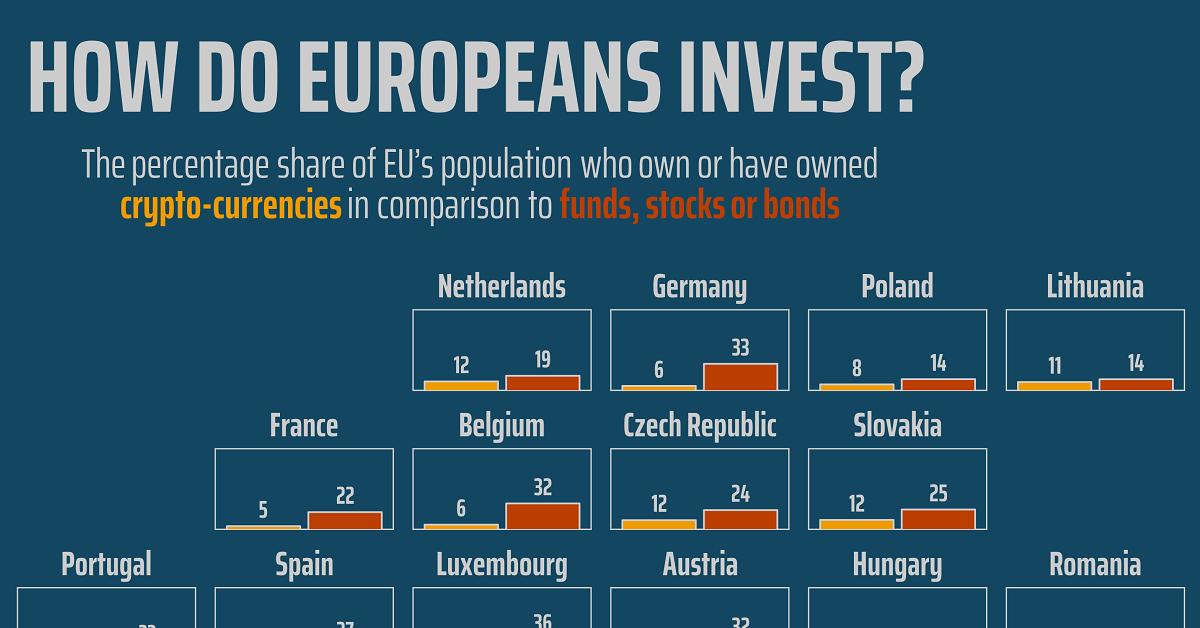

on For a modern example, we can see how different countries (and regions) act when it comes to cryptocurrency. Within the European Union—one of the regions dealing with faster crypto adoption—attitudes towards investing can vary considerably. This graphic from Gilbert Fontana looks at crypto popularity amongst investors in the EU using data from the European Commission’s Eurobarometer. It compares exposure to cryptocurrencies relative to stocks, funds, and bonds.

Crypto Popularity in Europe in 2022

Given that crypto has experienced bubble-like asset rallies, including a dramatic rise to over a trillion dollars in value before crashing, it’s fair to say it’s well known by now. But even with a vast rise in awareness, there are still discrepancies between the level of investment crypto receives amongst European Union nations. Let’s see which countries have the highest proportion of citizens invested in crypto: Topping the list is Slovenia, considered by some the most crypto-friendly nation in the world. According to the survey, 18% of the country’s population has some sort of investment in it. Cyprus also ranks high in its crypto-friendly rank and hits an investment figure of 13%. Also notable is the Grand Duchy of Luxembourg, which despite having a small population of 640,000 also has a strong reputation as a global financial hub. When it comes to crypto, 14% of the population owns or has owned the asset, relative to 36% for stocks, bonds, or funds.

Crypto Unpopularity?

In regards to the countries with lower levels of crypto investment, one observation is that they tend to be wealthier and more developed EU nations. Here’s how the nations at or below the 10% crypto-investment threshold rank: At the “bottom” of crypto interest are France, Germany and Italy, also the EU’s largest economies. At a glance, this might suggest that citizens of stronger economies invest less in crypto. However, it’s important to note that the countries with higher levels of crypto investment tend to have lower levels of wealth on average. Though less of their investors seem to engage in crypto trading, countries like France and Germany might have more comparable levels of crypto investment on a pure dollar-basis.