Presented by: Nevada Energy Metals, eCobalt Solutions Inc., and Great Lakes Graphite

The Critical Ingredients Needed to Fuel the Battery Boom

We’ve already looked at the evolution of battery technology and how lithium-ion technology will dominate battery market share over the coming years. Part 4 of the Battery Series breaks down the raw materials that will be needed for this battery boom. Batteries are more powerful and reliable than ever, and costs have come down dramatically over years. As a result, the market for electric vehicles is expected to explode to 20 million plug-in EV sales per year by 2030. To power these vehicles, millions of new battery packs will need to be built. The lithium-ion battery market is expected to grow at a 21.7% rate annually in terms of the actual energy capacity required. It was 15.9 GWh in 2015, but will be a whopping 93.1 GWh by 2024.

Dissecting the Lithium-Ion

While there are many exciting battery technologies out there, we will focus on the innards of lithium-ion batteries as they are expected to make up the vast majority of the total rechargeable battery market for the near future. Each lithium-ion cell contains three major parts:

- Anode (natural or synthetic graphite) 2) Electrolyte (lithium salts 3) Cathode (differing formulations) While the anode and electrolytes are pretty straightforward as far as lithium-ion technology goes, it is the cathode where most developments are being made. Lithium isn’t the only metal that goes into the cathode – other metals like cobalt, manganese, aluminum, and nickel are also used in different formulations. Here’s four cathode chemistries, the metal proportions (excluding lithium), and an example of what they are used for: While manganese and aluminum are important for lithium-ion cathodes, they are also cheaper metals with giant markets. This makes them fairly easy to procure for battery manufacturers. Lithium, graphite, and cobalt, are all much smaller and less-established markets – and each has supply concerns that remain unanswered:

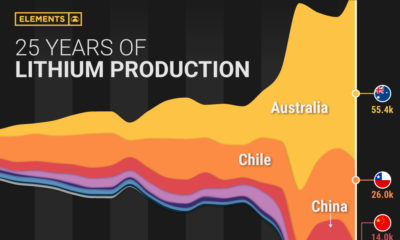

South America: The countries in the “Lithium Triangle” host a whopping 75% of the world’s lithium resources: Argentina, Chile, and Bolivia. China: 65% of flake graphite is mined in China. With poor environmental and labor practices, China’s graphite industry has been under particular scrutiny – and some mines have even been shut down. Indonesia: Price swings of nickel can impact battery makers. In 2014, Indonesia banned exports of nickel, which caused the price to soar nearly 50%. DRC: 65% of all cobalt production comes from the DRC, a country that is extremely politically unstable with deeply-rooted corruption. North America: Yet, companies such as Tesla have stated that they want to source 100% of raw materials sustainably and ethically from North America. The problem? Only nickel sees significant supply come from the continent.

Cobalt hasn’t been mined in the United States for 40 years, and the country produced zero tonnes of graphite in 2015. There is one lithium operation near the Tesla Gigafactory 1 site but it only produces 1,000 tonnes of lithium hydroxide per year. That’s not nearly enough to fuel a battery boom of this size. To meet its goal of a 100% North American raw materials supply chain, Tesla needs new resources to be discovered and extracted from the U.S., Canada, or Mexico.

Raw Material Demand

While all sorts of supply questions exist for these energy metals, the demand situation is much more straightforward. Consumers are demanding more batteries, and each battery is made up of raw materials like cobalt, graphite, and lithium. Cobalt: Today, about 40% of cobalt is used to make rechargeable batteries. By 2019, it’s expected that 55% of total cobalt demand will go to the cause. In fact, many analysts see an upcoming bull market in cobalt.

Battery demand is rising fast Production is being cut from the Congo A supply deficit is starting to emerge

“In many ways, the cobalt industry has the most fragile supply structure of all battery raw materials.” – Andrew Miller, Benchmark Mineral Intelligence Graphite: There is 54kg of graphite in every battery anode of a Tesla Model S (85kWh). Benchmark Mineral Intelligence forecasts that the battery anode market for graphite (natural and synthetic) will at least triple in size from 80,000 tonnes in 2015 to at least 250,000 tonnes by the end of 2020. Lithium: Goldman Sachs estimates that a Tesla Model S with a 70kWh battery uses 63 kilograms of lithium carbonate equivalent (LCE) – more than the amount of lithium in 10,000 cell phones. Further, for every 1% increase in battery electric vehicle (BEV) market penetration, there is an increase in lithium demand by around 70,000 tonnes LCE/year. Lithium prices have recently spiked, but they may begin sliding in 2019 if more supply comes online.

The Future of Battery Tech

Sourcing the raw materials for lithium-ion batteries will be critical for our energy mix. But, the future is also bright for many other battery technologies that could help in solving our most pressing energy issues. Part 5 of The Battery Series will look at the newest technologies in the battery sector.

on

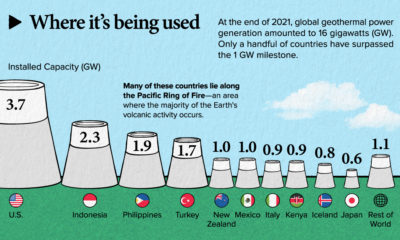

#1: High Reliability

Nuclear power plants run 24/7 and are the most reliable source of sustainable energy. Nuclear electricity generation remains steady around the clock throughout the day, week, and year. Meanwhile, daily solar generation peaks in the afternoon when electricity demand is usually lower, and wind generation depends on wind speeds.As the use of variable solar and wind power increases globally, nuclear offers a stable and reliable backbone for a clean electricity grid.

#2: Clean Electricity

Nuclear reactors use fission to generate electricity without any greenhouse gas (GHG) emissions.Consequently, nuclear power is the cleanest energy source on a lifecycle basis, measured in CO2-equivalent emissions per gigawatt-hour (GWh) of electricity produced by a power plant over its lifetime. The lifecycle emissions from a typical nuclear power plant are 273 times lower than coal and 163 times lower than natural gas. Furthermore, nuclear is relatively less resource-intensive, allowing for lower supply chain emissions than wind and solar plants.

#3: Stable Affordability

Although nuclear plants can be expensive to build, they are cost-competitive in the long run. Most nuclear plants have an initial lifetime of around 40 years, after which they can continue operating with approved lifetime extensions. Nuclear plants with lifetime extensions are the cheapest sources of electricity in the United States, and 88 of the country’s 92 reactors have received approvals for 20-year extensions. Additionally, according to the World Nuclear Association, nuclear plants are relatively less susceptible to fuel price volatility than natural gas plants, allowing for stable costs of electricity generation.

#4: Energy Efficiency

Nuclear’s high energy return on investment (EROI) exemplifies its exceptional efficiency. EROI measures how many units of energy are returned for every unit invested in building and running a power plant, over its lifetime. According to a 2018 study by Weissbach et al., nuclear’s EROI is 75 units, making it the most efficient energy source by some distance, with hydropower ranking second at 35 units.

#5: Sustainable Innovation

New, advanced reactor designs are bypassing many of the difficulties faced by traditional nuclear plants, making nuclear power more accessible.

Small Modular Reactors (SMRs) are much smaller than conventional reactors and are modular—meaning that their components can be transported and assembled in different locations. Microreactors are smaller than SMRs and are designed to provide electricity in remote and small market areas. They can also serve as backup power sources during emergencies.

These reactor designs offer several advantages, including lower initial capital costs, portability, and increased scalability.

A Nuclear-Powered Future

Nuclear power is making a remarkable comeback as countries work to achieve climate goals and ultimately, a state of energy utopia. Besides the 423 reactors in operation worldwide, another 56 reactors are under construction, and at least 69 more are planned for construction. Some nations, like Japan, have also reversed their attitudes toward nuclear power, embracing it as a clean and reliable energy source for the future. CanAlaska is a leading exploration company in the Athabasca Basin, the Earth’s richest uranium depository. Click here to learn more now. In part 3 of the Road to Energy Utopia series, we explore the unique properties of uranium, the fuel that powers nuclear reactors.