It’s the epicenter of the tech boom, and a magnet that attracts talent, ideas, and capital to come together to create new things. Software mania has shifted the most important corporate addresses in the country from the streets of Manhattan to obscure towns like Mountain View, Cupertino, or Menlo Park. While a booming ecosystem has lured many to the Valley, it’s simultaneously unlocked new technologies that have made it possible to work, collaborate, and build new startups from anywhere. The result has been the birth of influential startups and ecosystems in every locale imaginable – and today, it’s true that nearly every state has an impressive tech startup to call its own.

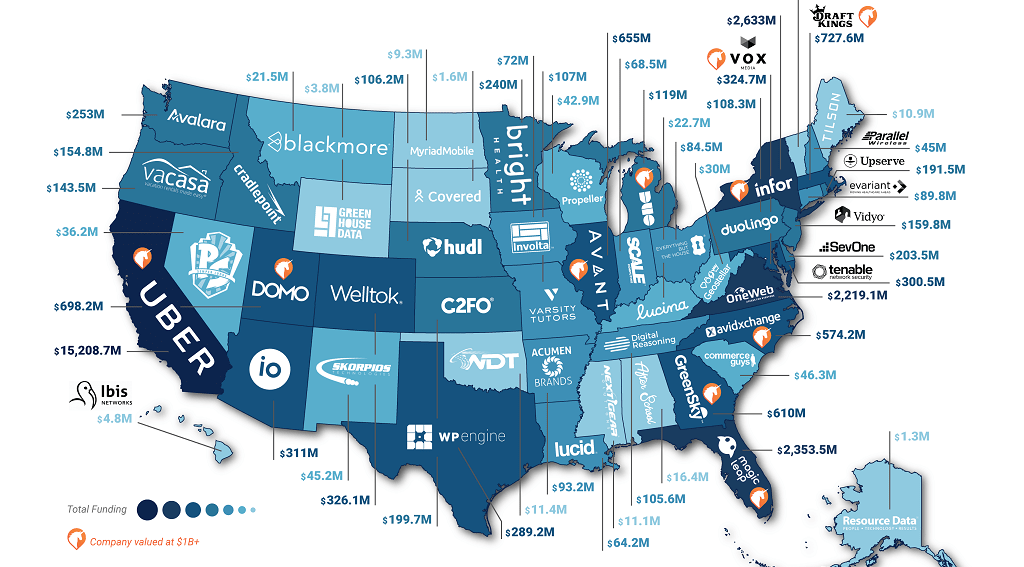

Best Funded Startups by State

Today’s infographic comes to us from CB Insights and it showcases the best funded VC-backed startups in every state with more than $1 million in disclosed equity financing since 2015. Here’s the best funded startup in each state (and D.C.) as of May 23, 2018: It’s important to note that three states did not meet CB Insight’s exact requirements for this list: Alaska, Mississippi, and Wyoming. As a result, those states are represented by private startups that have raised money since 2015, but they have not disclosed any VC-backing.

Uber Versus All

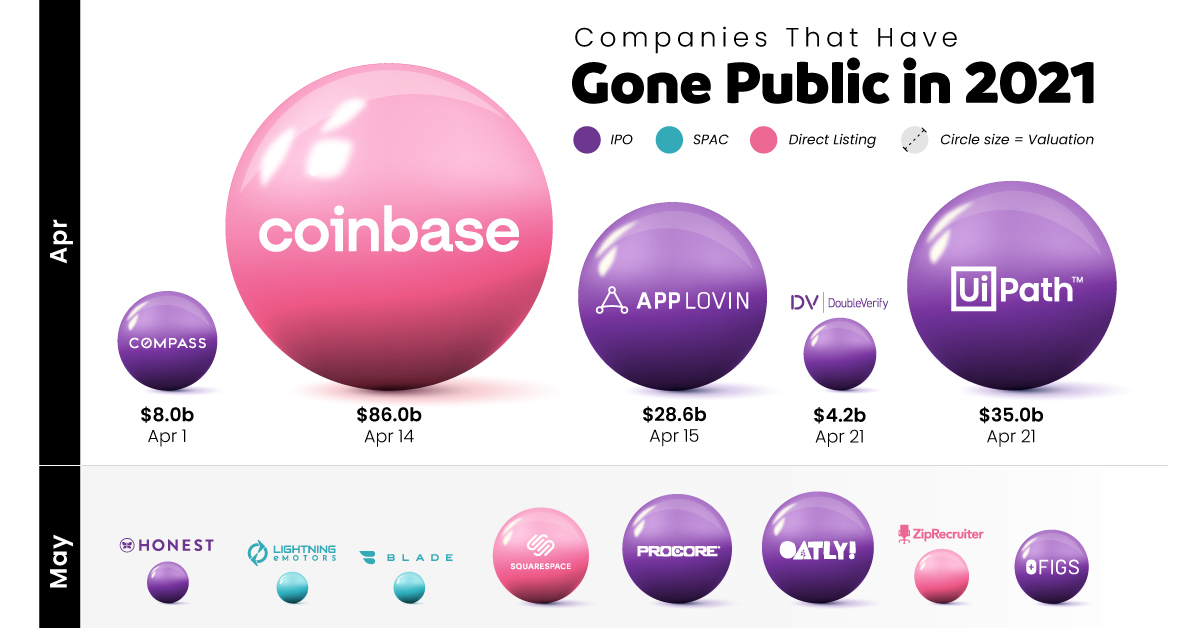

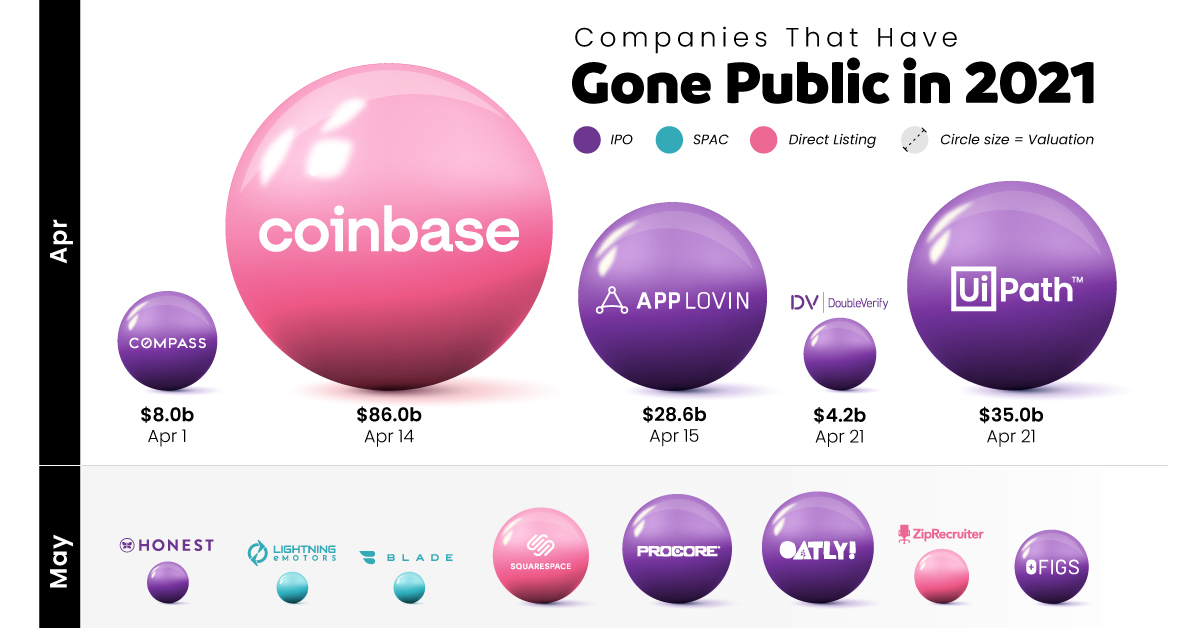

Although prominent startups are being backed by venture capital in practically every state, the Golden State still shows why it’s still the startup mecca. Uber has raised $15.21 billion in funding, which is actually more than the best-funded startup in every state combined together: Uber (California): $15.21 billion The Best Funded Startup In Every Other State (50 companies): $15.0 billion The other startups are no slouches either – they are represented by household names like Vox Media (D.C.), Magic Leap (Florida), Draft Kings (Massachusetts), and Domo (Utah), as well as many other successful companies. Uber is a funding outlier even among California-based companies, with Lyft ($4.8 billion) and Airbnb ($4.4 billion) being the next best funded startups in the state. on From much-hyped tech initial public offerings (IPOs) to food and healthcare services, many companies with already large followings have gone public this year. Some were supposed to go public in 2020 but got delayed due to the pandemic, and others saw the opportunity to take advantage of a strong current market. This graphic measures 68 companies that have gone public in 2021 — including IPOs, SPACs, and Direct Listings—as well as their subsequent valuations after listing.

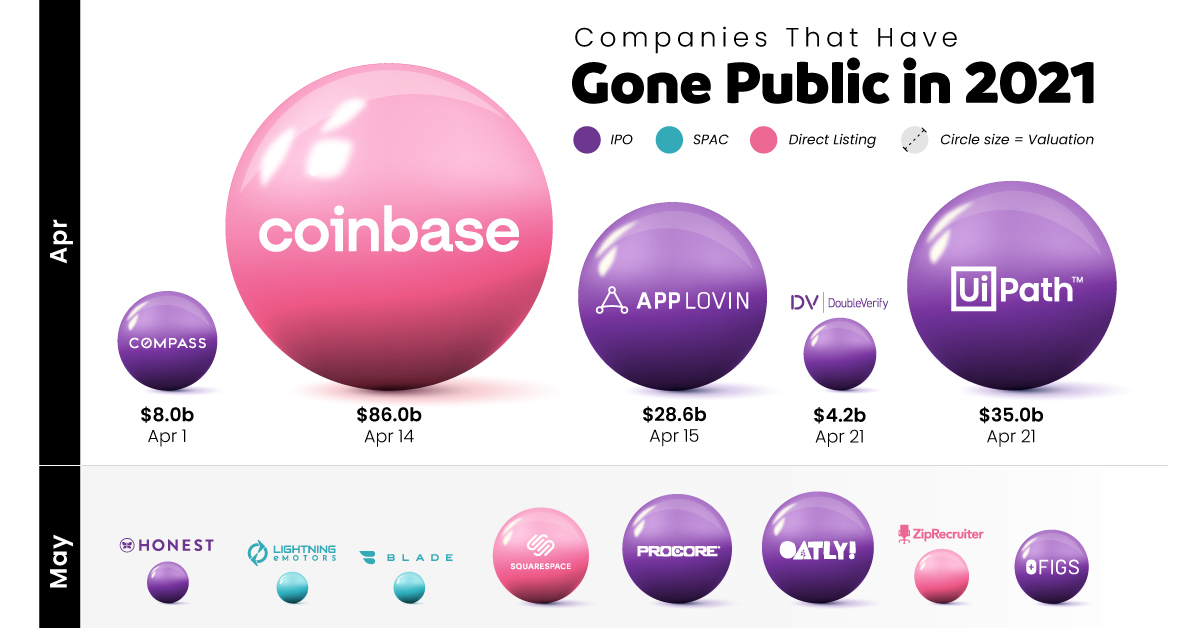

Who’s Gone Public in 2021?

Historically, companies that wanted to go public employed one main method above others: the initial public offering (IPO). But companies going public today readily choose from one of three different options, depending on market situations, associated costs, and shareholder preference:

Initial Public Offering (IPO): A private company creates new shares which are underwritten by a financial organization and sold to the public. Special Purpose Acquisition Company (SPAC): A separate company with no operations is created strictly to raise capital to acquire the company going public. SPACs are the fastest method of going public, and have become popular in recent years. Direct Listing: A private company enters a market with only existing, outstanding shares being traded and no new shares created. The cost is lower than that of an IPO, since no fees need to be paid for underwriting.

The majority of companies going public in 2021 chose the IPO route, but some of the biggest valuations resulted from direct listings. Though there are many well-known names in the list, one of the biggest through lines continues to be the importance of tech. A majority of 2021’s newly public companies have been in tech, including multiple mobile apps, websites, and online services. The two biggest IPOs so far were South Korea’s Coupang, an online marketplace valued at $60 billion after going public, and China’s ride-hailing app Didi Chuxing, the year’s largest post-IPO valuation at $73 billion. And there were many apps and services going public through other means as well. Gaming company Roblox went public through a direct listing, earning a valuation of $30 billion, and cryptocurrency platform Coinbase has earned the year’s largest valuation so far, with an $86 billion valuation following its direct listing.

Big Companies Going Public in 2022

As with every year, some of the biggest companies going public were lined up for the later half. Tech will continue to be the talk of the markets. Payment processing firm Stripe was setting up to be the year’s biggest IPO with an estimated valuation of $95 billion, but got delayed. Likewise, online grocery delivery platform InstaCart, which saw a big upswing in traction due to the pandemic, has been looking to go public at a valuation of at least $39 billion. Of course, it’s common that potential public listings and offerings fall through. Whether they get delayed due to weak market conditions or cancelled at the last minute, anything can happen when it comes to public markets. This post has been updated as of January 1, 2022.