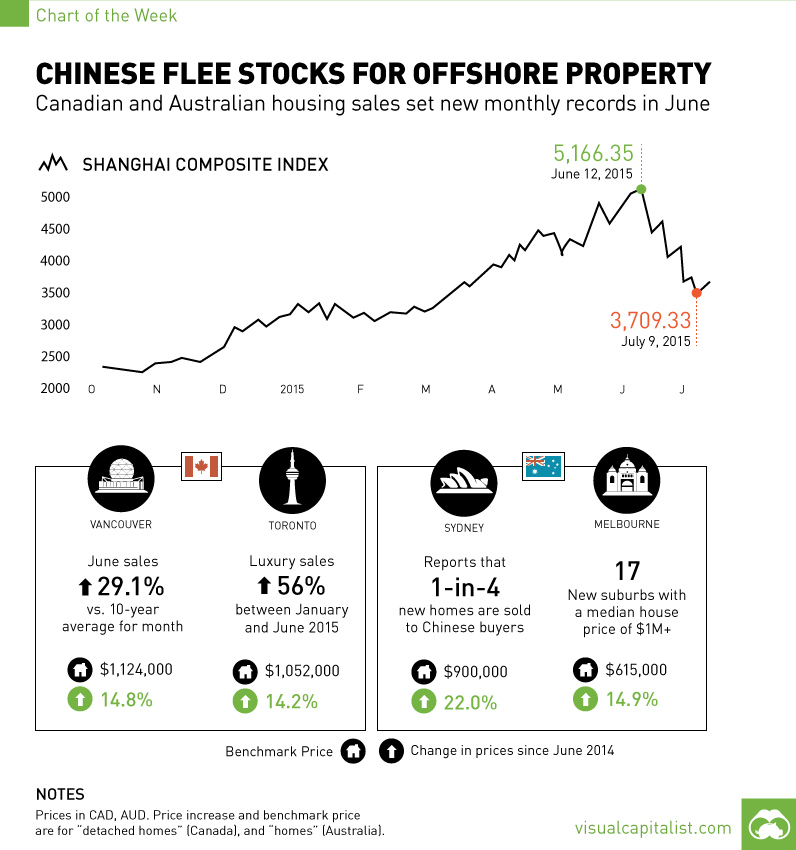

Trading Places: Chinese Flee Stocks for Offshore Property [Chart]

Canadian and Australian housing sales set new monthly records in June

The Chart of the Week is a weekly feature in Visual Capitalist on Fridays. Every transitioning economy has its growing pains. This turns out to be especially true when that economy is an unusual Jekyll-Hyde type of hybrid: it’s run by a communist government that favours control, but at the same time wants to harness the growth of free market dynamics. Over the last two years, the Chinese government has worked to relax margin restrictions. By changing these rules, it would allow more regular folks to borrow on margin to buy into and fuel the stock market. The only problem was that most of the public had never invested before, and intense speculative buying replaced any disciplined search for value or growth. The market soared to new heights. New investors saw the gains and just kept piling in. Between June 2014 and May 2015, more than 40 million new trading accounts were opened, and many of these new equity investors had less than a high school education. The Shanghai Composite Index, which tracks shares traded on Shanghai’s stock exchange, climbed over 150% since late 2014. Then, the party abruptly came to an end. Over the last month, the market crashed and lost about 30% of its value, worth about $3 trillion. The government had taken unprecedented steps to slow down the crash, including halting IPOs, cutting interest rates, and other “stability measures”. Top brokerages even pledged to collectively buy 120 billion yuan ($24 billion) of shares to steady the market. Finally, the China Securities Regulatory Commission banned sales of shares for major investors for six months, and suspended trading in over 1,000 stocks. The once frothy market has had mixed reactions over the last few days, but remains near its three month low.

The Pacific Connection

While surely some people have lost faith in Chinese stocks as of late, that doesn’t mean money wasn’t made. The market is still up 80% from a year ago and many that were in early made a killing. What are some of these people doing with their newfound capital? Many are buying real estate in China to store their wealth. In a survey carried out by the Southwestern University of Finance and Economics in Chengdu, 28,140 respondents were polled between June 15 and July 2. They found that more people were taking money from the stock market and buying property. In Q2, 3.7% of stock investors bought housing compared to 2.3% in the first quarter. Of those that bought property, 70% of households have made money in the stock market. People from China have also looked abroad to store their wealth in housing. It’s no secret that Canada, Australia, and the United States have all felt the effects of foreign buying in their property markets over the years. Cities such as Vancouver and Toronto have had an influx of new buyers fueling the boom, and this is part of the reason why Canada is now considered to have the most overvalued housing market in the world. Sydney and Melbourne have seen similar effects, and Australia was recently ranked by the Economist as the second most overvalued housing market relative to income. In the United States, the Bay Area continues to also have a bull market in property. Technology plays a big role in this, but foreign buyers have also been helping drive prices there as well. California is a popular destination for Chinese buyers, as 30% of all Asian-Americans reside in the Golden State.

The Numbers

In the month of June, housing prices and the number of sales have reached record levels in some of these markets. The two hottest Canadian markets remained on fire, despite the country edging into a technical recession. In Vancouver, housing sales were 29.1% higher than the 10-year average for the month of June. This brought the benchmark housing price to C$1.1 million for a detached home. June was the fourth straight month with over 4,000 sales, a new record for the city. Luxury sales rose 48% in the period between January and June compared to last year. Toronto’s luxury market is even hotter, with sales increasing 56% over the first half of the year. The benchmark housing price in the city for a detached home is now C$1.05 million, a 14.2% increase over the last year. Two of the more prominent markets in Australia also kept their momentum. In Sydney, prices have soared 22.0% over the last 12 months for homes, to a median price of A$900,000. Melbourne, which started to cool off in the beginning of 2015, found resurgence in June that brought it back to strong double-digit annual growth. Melbourne, which typically has less expensive homes than Sydney, Vancouver, and Toronto, is starting to join the million dollar club as well. Recently, there are 17 new postal codes that now have homes with A$1 million median prices.

From the Front Lines

The million dollar question is: to what extent do exits from the Chinese stock market and capital flight influence the markets in the above cities. Everyone can agree there is some influence, but narrowing down the specifics is much more difficult. This is because there are not many official records on the specifics of foreign ownership, and much of the time transactions are done indirectly through family and friends. Aside from the correlation with the numbers above, there is mainly anecdotal evidence from people on the ground. In Vancouver, for instance, a Reuters survey found that of 50 land titles for detached Vancouver Westside homes worth over C$2 million, that nearly half of purchasers had surnames typical of mainland China. Five real estate agents primarily focused on sales on Vancouver’s more luxurious west side estimated that between 50% and 80% of their clients had ties to mainland China. Michael Pallier, the Principal at Sydney Sothebys International Realty, said recently that volatility in the Chinese market was prompting more interest in local properties in the luxury market. “Last month in our office we sold 20 properties for $115 million turnover in June, of which 25 per cent were sold to Chinese buyers, so we do have a lot of experience dealing with Chinese markets,” said Mr. Pallier, “They’d rather put the money into a property than put it into cash or into shares.” David Fung, the vice-chair of the Canada China Business council, said that the stock market crash and volatility drives more investments into Canada, including British Columbia’s hot property market. “They’re not looking necessarily for a very high return because it is for their own insurance,” said Fung.

on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.